Vicom has released its first quarter results for the new financial year and investors were waiting anxiously regarding recent news of carmageddon surrounding more deregistration of cars in the next few years. I've made a couple of blog posts in the past about the company so i will not repeat too much into the details. For past articles, you can refer to here:

To be honest, this wasn't anything new that investors are not aware of. I've covered in my previous rounds of articles that the deregistration wave is coming so this might somehow impact the growth that Vicom used to enjoy in the past. I've updated below regarding the latest aging vehicle distribution as of 31 Mar 2015.

I wasn't particularly concerned about the recent wave of deregistering because this seems like a situation that is temporary that would subside once it has entered into a new cycle. My main concern is more on the regulating on the overall growth rate by LTA which is currently at 0.25%. If they decide to decrease the amount one day, that would become a permanent problem for the company.

Financials

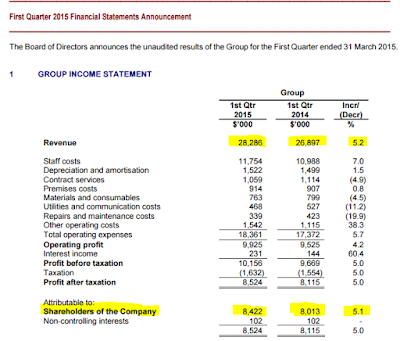

I'm generally happy with what I see in their Q1 results.

Both topline and bottomline enjoy a healthy single digit growth which I thought was decent given the recent vehicle deregistration issues they are currently facing.

Balance sheet has also gone stronger with higher cash balance accumulating in their books.

Capex figure remains low for this quarter, which indicates that they did not invest a lot of their cash into the non-vehicle testing of Setsco, though management reiterated that these segment continues to grow.

| 2011 | 2012 | 2013 | 2014 | 2015* | |

|---|---|---|---|---|---|

| EPS (cents) | 28.7 | 30.0 | 32.2 | 34.0 | 38.0 |

| Growth % | - | 4.3% | 7.4% | 5.9% | 11.7% |

| Dividend (cents) | 17.6 | 18.2 | 22.5 | 27.0 | - |

| Payout Ratio | 61.3% | 60.8% | 69.9% | 79.1% | - |

| Cash & Cash Equivalent ($m) | % of Total Asset | CAPEX Requirement ($m) | Net FCF ($m) | |

|---|---|---|---|---|

| 2011 | 55.2 | 41.2% | (12.2) | 22.3 |

| 2012 | 66.0 | 45.5% | (4.6) | 26.0 |

| 2013 | 78.5 | 49.6% | (3.9) | 28.5 |

| 2014 | 91.0 | 53.8% | (5.1) | 32.6 |

| 2015* | 98.0 | 55.3% | (2.2) | - |

Non-Vehicle Segments

The problem for us investors in trying to dissect the company's financial statement is they are very simplified in the presentation, thus making it very difficult for investors to dig deeper into the non-vehicle segments which becomes sort of a black pyramid box that we need to try to understand.

Fortunately, there was much more indication in the recent annual report they published regarding this segment which we can refer to for reference.

There was strong demand in the oil and gas, petrochemical, marine and offshore as well as construction industries, though they do acknowledge that the volatility of the oil price and slowdown in the construction business might cause a problem for all sectors.

In marine and offshore, Setsco has been involved in the number of high end projects involving the non-destructive testing of offshore oil platforms which include three floating production storage and offloading facilities, six semi-submersible drilling rigs and two jack-up rigs.

Setsco has also provided technical expertise in the areas of project management, groundwater drilling and water quality monitoring for the development of sustainable water solution using sand aquifers for JTC corporation.

Setsco has also rolled out automated cube testing system, where robots are used to carry out testing of concrete cubes, including scanning, feeding, lifting and weighing.

For overseas operations, Setsco has provided surface friction testing services for a helicopter landing deck located at Johor Port in Pasir Gudang. It was also appointed to set up and manage a laboratory that monitors the quality of concrete materials used for the construction of the Penang second Bridge.

If there is one thing I see in common about these businesses, they are mostly testing and inspection services for the diversified businesses which require very little capex from their side to run the operations. In other words, we should be seeing continuation of free cash flow being generated on a fairly comfortable level and cash balance should continue to keep increasing.

Final Thoughts

The management sounded cautious about the vehicle testing segment but from the look of it, it seems that they are able to neutralize this effect from their non-vehicle testing segment which they are confident it will continue to grow despite the recent woes about oil prices and construction businesses.

Unlike Sembcorp Industries who seems to be hit in both of their segments in utilities and marines, Vicom looks like they are able to manage the slowdown in vehicle deregistration rather well and from this, I gather that this is a good stock to hold for the long term.

Vested with 6,000 shares of Vicom as of writing.