Sembcorp Industries has announced its Q1 FY15 results for this evening after market close. Even though I had fully divested in the stock (original article here), I still keep a close lookout on its development and there are some things that I am particularly eyeing on in addition to what I've discussed in the past.

1.) Lower Utilities Net Profit (for Singapore segment)

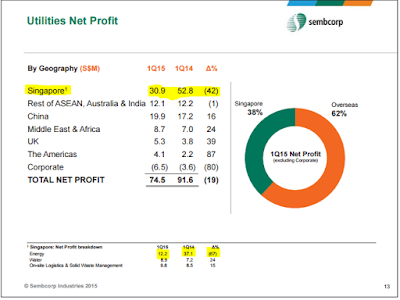

I am not sure why everyone is rather surprised at the drop in utilities we had for this financial year. I thought it's pretty obvious that with lower hsfo and oil prices, in addition to the higher competitive nature, we are going to see the segment performing worst than we had for previous year. Again, some may think that the overseas segment in particular the new India operations can make up for the weakness but as you can see below, the Singapore segment is the majority segment that are making up for the losses.

2.) Lower Energy Segment

If we break it down further, we see that the potential weakness came mainly from its energy while water and solid waste registered healthy increase.

Q1 13 - $39.2m

Q1 14 - $37.1m (-5.35%)

Q1 15 - $12.2m (-67.1%)

The drop in this quarter profit for energy is pretty shocking to be honest as they represent a 67% drop from the previous year. While lower HSFO and oil prices are undoubtedly causing margins to decline, we can't rule out that they may be losing some market share to competitors. In the slides, the management mentioned that vesting contract levels have dropped from 40% to 30% in 1H2015 and will fall further to 25% in 2H2015. If so, this could be worrying signs ahead we need to take note of in the future.

Expansion Capex remained high as the company embark on an aggressive mode of expansion. The latest won project for Myanmar probably signifies the company expansion plan and its use of its cashflow even more in the future. Again, the results can only be seen in the very long term once operations stabilize and commenced operations.

Conclusion

Trailing Earnings are going to see weaknesses in this financial year, perhaps "saved" by the divestment they made recently to their UK operations which will be recognized in Q2FY15. Dividends might also drop given the level of price weakness but I think the Singapore segment will see price weakness as low as it can get now. Balance sheet has also become much weaker as a result of taking on more leverage for expansion purpose.

Marines are not any better either. They probably are able to sustain their operations for the next few years but low project order won is a potential worry if low oil price is going to hang in the balance for longer.

Marines are not any better either. They probably are able to sustain their operations for the next few years but low project order won is a potential worry if low oil price is going to hang in the balance for longer.

Based on risk adjusted return, I just don't see the attractiveness to enter to the stock at this moment. Earnings for the financial year are weak, future is uncertain, and dividend payout is low for yield hungry investors. Unless you are one which are going to hold this for at least the next 5 years, I think we won't see any spectacular catalyst that will propel the earnings or cashflow to show for any upside.

Remain on the lookout but not vested for now.