I was highlighted from a fellow blogger, Richard from Invest Openly regarding the upcoming healthcare related IPO which will be listed in the Catalyst. Many people are comparing this against related healthcare Raffles Medical which are now trading at around 30x PER. For me, I'd see this more towards the proxy of Cordlife, since they are in the industry of gynaecology and birth rates grooming.

A total of 43.6 millions of shares were offered but only 2.2 millions were offered to the public, which translates into about $550K in absolute figure. In my opinion, this is way too little and they probably want to get long term institutional investors to come in and grab the rest while leaving little to the public.

I took a quick look at the prospectus and develop the following thoughts:-

1.) Financials look really solid there.

It's hard to find companies netting a profit margin in the above range of 35% and this shows exactly how expensive is our medical costs in Singapore. For me, they are sitting in such a sweet position that even if costs do go up or outlook are a bit mediocre, they have the buffer to take it on comfortably.

2.) Dividends Payout is really enticing here at 90% of net profit for FY2015.

Even though they maintained that they do not have a fixed dividend policy, it looks like this is a sweetener deal to entice investors into investing in the shares, as they are "willing" to share their huge profits with the minority shareholders. We'll see in due time if they can continue to maintain that, which I am a bit skeptical of because they only retained so little earnings used for expansion, if any. The yield is projected to be at 7.3% at the IPO price. Note that this is unlevered dividend yield, unlike the structure of Reits that pays out the same payout but levered.

3.) Balance Sheet looks real solid here with zero net gearing and rich cash position.

Woolala, I have a soft spot for companies that has strong earnings capability with huge cash hoard and zero debt. Perhaps the impending increase rate increase has something to do with it lately. In any case, I suspect they might go into debts once the expansion plans are properly in place since the $3m proceeds (explained later) that goes into expansion looks unlikely to be sufficient.

4.) Use of Proceeds

Based on the prospectus, $9.2 millions are expected from the IPO after deducting relevant expenses. The proceeds will go into:

I like the fact that they are not using the proceeds mostly for working capital purpose (discussed later). $3M will go into expansion while the rest of the other $6M will go into investments in synergistic businesses such as child care services, paediatrics, etc.

Having a kid of my own, I know how much profitable it is to have such an extension works out that are child related. I see this as extremely positive move.

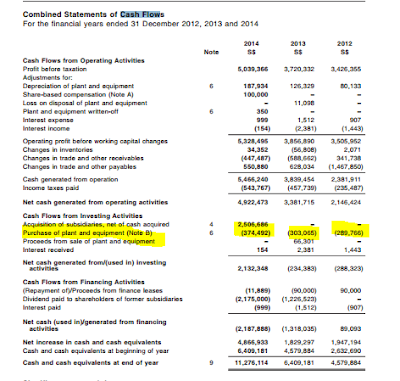

5.) Cashflow generating capability

This is my next favorite section of looking at businesses.

Capex remains low since the majority of their expenses would have come under the salaries portion which already make up of the cash flow from operating, so operating cashflow and fcf is generally very strong. Based on the prospectus, ipo price to operating cashflow is at 8.9x and against fcf is at 8x. That is pretty good if you ask me.

6.) Business Model

The kind of business model the company is operating is very similar to what I previously blogged about Vicom.

First, you have regular customers that are unlikely to switch out once you locked them down, unless they have a very bad experience to start with. Also, with their expansion plan regarding the paediatrics and child care services, they can tag on their existing customer base to the extension service.

Next, most of their costs come mainly from the salaries they use to pay the doctors. Finding the right expertise could be an issue but somewhere in the prospectus they mentioned about allowing doctors and professional who want to switch from a public to private practice to come in and join them. We know that when they do that, they probably bring in their regular clients with them.

The company also mentioned that they have gained more market share during the past few years so given the medical hub Singapore is trying to place itself in, it looks like they are in a sweet spot to enjoy the government initiatives.

Final Thoughts

I generally like what I see in their prospectus and outlook.

The thing that I am still considering is given the low public float they are offering, everyone might get only a tiny slice of the company. We can take a look at Starburst for instance, where the ipo was over-subscribed by more the 9x and those who bidded for 100 lots did only manage to get 5 lots.

I think the share price would do well on its first day of trading and for the upcoming years to come. I might just bid for the ipo if I think it wouldn't be a waste of time getting tiny lots from it.

Last Update: I have made an application bid of 101,000 shares for the IPO. Will update the outcome of the application.

Last Update: I have made an application bid of 101,000 shares for the IPO. Will update the outcome of the application.