Sembcorp Industries have recently announced their full year results for the financial year ended 2014 and you can view the results on their website which I will not repeat and go through in detail here. I just wanted to focus on a few details which I am looking out for.

1.) Utilities by Segmental

I've personally known many investors who are invested in SCI due to their resilient business in the utilities. We think that utilities is a segment that is defensive in nature and will be recurring and growing over time. Like any business, there is always the risks of competitor threatening and this is no exception. Never had we thought that the risk of a competitor would threaten the utilities business so fast which leads to the decline in the profit margin drastically. As an investor for the company, I think the key is to particularly look out for decline in the local segment and how much it will decline further in the future.

If we take a look at the utilities breakdown in detail, the major shortfall is coming in from a decline in the energy power segmental portion of the business. Total year on year we are looking at a drop of about 25% in the energy segment alone. What literally hide this segmental portion was the 4th quarter spectacular results from the Water and On-site Solid Waste segment to bring the total core up by 7%. Nevertheless, you still can't deny that the energy is key to the long term growth of the utilities business as we will see later that their capex is mainly focused on this part of the business.

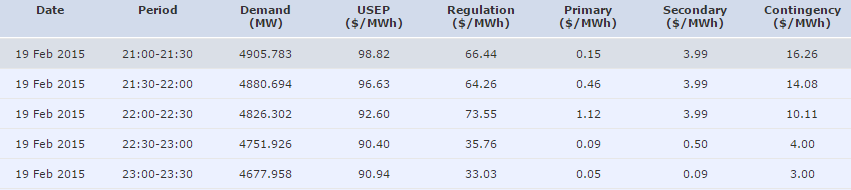

You might recall that a couple of months ago I posted the Uniform Singapore Energy Price Index (USEP) for the past 3 years. The trend is clearly on the way down and we will see what the threshold is for 2015 currently. Fast forward to 19th Feb 2015, the USEP is currently at the average of about $96/MWH. It's clearly declining due to competitive bidding from competitors and the lower oil prices doesn't help. It appears that this is causing some serious profit margins decline in the energy segment.

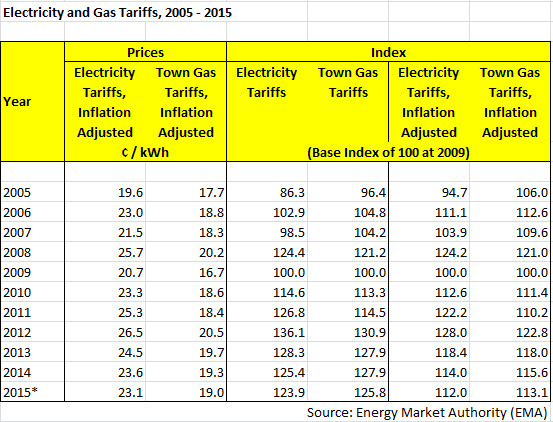

The other thing to take note for this energy segment is the lower electricity tariffs from the weaker High Sulphur Fuel Oil (HSFO) which you can see was adjusted downwards due to the low oil environment we are at right now. I don't know if you as consumers notice about this but I have personally been seeing lower kwh charges and they have been refunding me on some of the deposits which indicate lower electricity charges these days.

Now, if we look at the geographical segmentation for the utilities business, we see that the SG portion is declining but the rest have contributed positive growth on the bottomline. The main reason as explained above is of course other than the low global oil prices there is also stiff competition from competitors such as Senoko, Power Seraya and Tuas Power, which has a bigger capacity than SCI itself. The China (due to stronger contribution from the wind power asset) and Rest of Asia (competitive electricity tariffs) are still performing growth though do note that the UK profits include the one off divestment gain from the sale of one of its business.

2.) Maintenance vs Investment Capex

Based on the presentation from the management, they have revealed that out of $1,586M of investment and capex, $1,469M belongs to investment capex while the rest goes to maintenance capex. This translates into a percentage of about 92.6% for investment capex and only 7.4% for maintenance capex. In my previous valuation post which you can view here, I tried to estimate the capex between the two and came up to a rough percentage of 64% for investment capex and 36% for maintenance capex. I am actually pretty surprised that their maintenance capex came up to be very low. In other words, they are expanding pretty aggressively for the past few years now. The company did cite that the marine business might see a slowdown in the expansion capex so we'll see a lower figure in the upcoming few years.

If we take a look at their pipeline over the next few years, we will be seeing more positive contributions from the energy portion from India, which could cushion the decline in SG. Already, we should see some contributions kicking in from India with the commencement of their Unit 1 TCPIL by 2015 and another Unit 2 will follow in 2016. The Water segment is growing well so we'll see another positive contributions there. Having said that, I just feel the decline in SG might be a little too big to cover from the India contributions at this point so we might still see some pressures unless the other segments can step up to cover this yet again.

3.) Balance Sheet

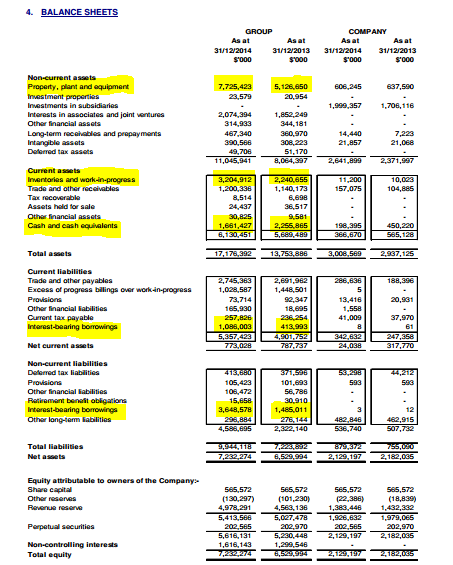

We shouldn't forget about how the company is structured in terms of its balance sheet now.

The highlighted portion is what I think we should be looking out for the major changes.

A quick overall look and we can see that the company book value is on its way up now with the obvious positive profit contributions retained (less dividend payouts of 36%) for aggressive expansion purpose.

The company's borrowings have visibly increased now due to their consolidation of TPCIL and part stake in the marine business from SMM. With expansion slowing down from the marine side, I expect the company to repay quite a bit of the borrowings in FY2015.

The Inventories and Work-in-Progress portion increased due to payment terms of the rig building projects from the marine side. This could be a worry if there are delay or payment default should the global oil decline further which means that cashflow could be tied up over here.

Overall, I just feel that the company's overall balance sheet has come under pressure due to their aggressive expansion mode from both from the utilities and marine and they are unable to recover their cashflow as soon as possible due to the nature of the payment terms of the rig.

Final Thoughts

I think as long as the oil price continues to consolidate or decline from current stage, we won't be seeing a much improved year on year growth on the EPS for the company.

The utilities segment of the business is still in the midst on the expansion mode and any positive contributions from other areas will only mitigate the losses in the SG geographical segment. The marine business has an order book filled until 2019 so unless there are any drastic cancellation we will probably see its profits being maintained similar to FY14. The rest of the other business is still too small to make a positive contributions on the overall.

I have no doubt that the company will still be able to achieve about 44-46 cents EPS for FY15. Paying out a rough 16 cents dividends (a drop from last year of 17 cents which do not worry me), they will be able to retain the rest of the 64% for investment growth purpose, though based on calculations they will need a lot more money on this.

Until we see a recovery in the oil price, we'll probably see continued pressures for its stock price to hang around the current range.

Vested with 9 lots and will continue to be vested and observe further.

What about you? Are you still holding on to this?