I have been watching out for a few lists of property stocks lately where they are trading at a discount to their book value. This is not surprising given the disappointing market sentiment towards various property curbs we have in Singapore such that companies are holding massive amount of property development in their books, and with prices going southwards, we have a discount to their book value. YTD the stock has been underperforming the STI index by returning about negative 10%.

OUE is one of the stocks that caught my attention given their attractive valuations (I will talk about it more in detail below). Because of this, I have initiated a small position of 5 lots at a price of $2.16.

OUE Limited is an investment holding company which have operations in the Hospitality, Commercial and Residential development. They have recently found ways to unlock shareholder’s value by incorporating two Reits wings under them - OUE Hospitality Trust and OUE Commercial Trust. The thing I like about the incorporations of these Reits is it allows the company to work on the financial engineering part where you have sort of a dumping ground to sell the companies at valuation price and the capital can be recycled. For example, before Mandarin Orchard and Gallery were injected into the Trust, these assets were valued at their cost value where it sits under the PPE statement of the balance sheet and they cannot be revalued upwards (accounting treatment for PPE are depreciated instead). By disposing these assets to the Trust and OUE becomes the associated partner stake, the assets can be revalued upwards and thus NAV has improved now to $4.04 from $3.1 previously.

I predict it will only be a matter of time before they start disposing their other assets into the Trust. A quick look at their current property holdings and Crowne Plaza Changi Airport looks most likely next to be disposed to OUEHT. The current carrying amount for the property is carried at cost value at $229M in their books while the latest market appraisal is valuing the property at $291M. That’s a valuation surplus of $61M they would record in their books should the asset be disposed. Potential NAV could rise to $4.55 as a result of this, assuming everything else remains the same. This is financial engineering at their best.

There could also be opportunities in the future to dispose other assets such as OUE Downtown and US Bank Tower into the OUECT. These assets of course are already valued at their fair value figure since these are property investment assets, so the current NAV would have already accounted for it.

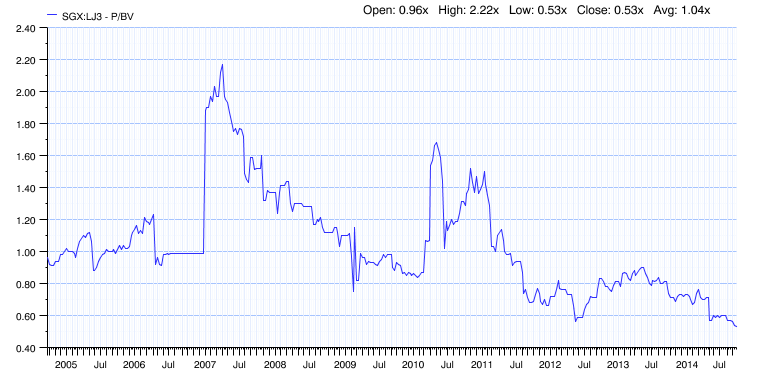

Since I am buying at $2.16, and the NAV is currently at $4.04, this represents a P/BV of 0.53 – which means that I am buying the stock at a 47% discount to their book value. I thought that was pretty decent given the level of margin of safety against their book value. If we exclude the portion of the cash and include 100% of the total liabilities in the computation to be very conservative, $2.16 essentially means I am buying the rest of the other assets at a 0.63x to its stated value. That’s real bargains there.

Going back to the past 10 years of data, we see that the current P/BV of 0.53 today is the lowest ever in the past 10 years of history. Even during the GFC, its P/BV is at 0.75x while during the Euro crisis it was at 0.56x. Again, this is another factor for buying something which is value that the market is not pricing in.

I think this stock will take time to evolve. By having two wings under their reits management, it is a matter of time before the management unlock the assets under their books and inject them into the reits. By buying the stock at a P/BV of 0.53x, I think the level of margin of safety is there and it is now just a waiting time for the management to do their job.