Before you continue to read the rest of the article, I have to warn that it's going to be another piece of pessimistic view which follows from the previous article. This article is written since we are in the midst of a global rebound from the turmoil of the recent Chinese and US market, so I thought it might come in handy and practical. For others, I'll promise to write some happier views in my next post at best.

Small Cap stocks have been one of my personal favorite in recent years. These stocks have some of the best earnings potential and balance sheet we've ever seen compared to others and valuations are not unreasonable. Fellow blogger, Investment Moat, has written an article about small stocks (Link Here) and he mentioned that not all picks of these small cap stocks will work out. There will be a couple which will propel multi-bagger returns for the portfolio while the rest are probably value traps. It is the responsibility of the investors to dish out the value play from the value trap and some luck probably plays a part more than skills. This is vastly different from picking some of the blue chip names we are more familiar with because the latter are usually backed by more powerful institutional and sovereign funds, compensated by a much more expensive valuations.

For the purpose of this exercise, I am going to pick up some of the small cap stocks which interest me and conduct a stress test tolerance on these stocks. I will also be using the most recent 2008 GFC and 2011 Euro Crisis as part of the stress test trough period to see how these stocks are doing back then and now.

- China Merchant Pacific

- Riverstone

- Silverlake Axis

- UMS

- Sarine Tech

- Nam Lee Metals

- Second Chance

- Boustead

- Kingsmen

Balance Sheet Strength

The first stress test is to check on the strength of their balance sheet.

On the overall, it looks like most companies have a much stronger balance sheet now as compared to back then in 2008 and 2011. Companies which are visibly in the net cash position for years have grown their cash position to even more in 2015, with Riverstone, Silverlake and Kingsmen leading the pack. I've previously mentioned that while keeping cash increases the strength of the balance sheet in general, hoarding too much cash may not be the best decision as it erodes the long term roe of the company.

Companies which are in the net gearing position such as China Merchant Pacific, Second Chance and Boustead are usually asset heavy, with mostly PPE or properties development consisting the majority part of their assets. This does not immediately discount them as being inferior from the rest, it just simply means that they are not as liquid as the rest who are in the net cash position.

|

| Balance Sheet Stress Test |

|

| Net Cash as a percentage of market cap % |

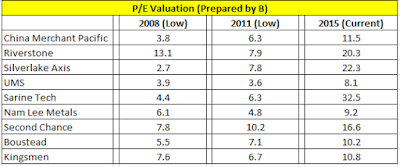

Earnings Valuation

The second stress test is on their respective earnings valuation.

Given the overall general market trend, it's not surprising to see that most, if not all current earnings valuation are much higher now as compared to the low of 2008 and 2011. Most of these counters have a much stronger balance sheet now as compared to the past, but that doesn't mean that the low of 2008 and 2011 will not be repeated. We just need to know that it CAN happen to allow us to prepare for more room for unexpected things.

I've also included below the implied potential downside risk based on the latest earnings should we revisit again the magnitude of 2008. They are not the holy grail methodology to compute the implied downside, but they are definitely an important mitigation risk that investors need to consider should the world goes into extreme turmoil once again.

|

| Earnings Valuation Stress Test |

Final Thoughts

There's plenty of local investors and friends who have expressed their interests in awaiting for the correction to come and that is a good sign because I'm basing on the assumption that they are ready to stomach the downside and take the opportunities given, either through having sufficient warchest to deploy or having the right mentality to approach them.

The investors from the 2008, 2011 and 2015 will tell you different stories because they have walked and experienced the different walks of life, given the different magnitude of their investing experience in the market. Those who have experienced the magnitude downturn of 2008 will have expanded their mentality of how much they can afford to stomach, including dealing with the less certainty of job security, lesser salary increment, bonus and the noise coming in from all over the media.

If you think just by investing in blue chips you are spared, you may want to revisit those time when Creatives and NOL are still blue chips or read this post I've written earlier about blue chips (Link Here).

For myself, even though I am currently holding a warchest of around 35% in the overall portfolio, I would be a liar if I tell you that severe market downturn does not totally affect me mentally. Take existing investors of Silverlake (vested myself) for instance. We invest in the business because we are determined and confident in their business moat, financials and management, but whoever tell you that they are not affected mentally when the implied share price potential downside is $0.12 (see table above) will be lying straight through their pants. When you see your share price goes down from the high to the extreme low, you'll be asking a lot of questions, including your ability to prospect the company in a logical and efficient manner.

Let me give you another analogy in more layman terms. I am a sucker for eating Salmon fish. Whenever I go to the supermarket, I would check for discounts on the Salmon they are offering on that day. Salmon is an expensive dish, so I'm most likely to buy when they are offering discounts, given the certain limitations that I would have to eat them within the next 2 days since it's probably not the freshest around. I love such deals because there are compromises between myself and the supermarket. They can get rid of the stock while I can get cheap Salmon that I like. However, should the day comes when I see Salmon is offering at $0.01 (extreme discounts), I'll be up on my feet and be very wary because I would be asking if my prospecting of the expiry date was wrong or in fact if they have already expired. I think you get the idea.

I'm not trying to scare the hell out of investors out there but you can't deny that in the stock market, anything is possible and probable. Even given the best preparation you have made out there, you still need to constantly review your prospecting of the business, your asset allocation, your job security, your downside tolerance level and your ability to survive and prosper during a severe market downturn.

Thanks for reading,

Vested in China Merchant Pacific, Silverlake Axis, Nam Lee Metals and Kingsmen as of writing.