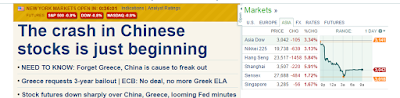

I could sense some form of excitement amongst my fellow financial bloggers and facebook group of friends. Today, the Shanghai and HSI market plunged rather badly, providing contagion to its nearby market Nikkei as well as STI and the rest of the Asian market. The feeling of "correction is finally here" has risen amongst the more seasoned investors, but there are some who feel trapped and scared, perhaps given their lack of experience investing in the market, either through herd investing or investing at the peak of the share price.

I think it's probably a good time to look back at some of the recent posts I made in relation to what investors should be doing during a market downturn. This doesn't take away the emotional fear which investors would naturally possess, but rather a clarity on what investors should expect during a market correction.

The Firefighter Gene Way Of Investing

What Should You Be Doing In Current Market Conditions?

What Is Your Goal In Investing?

Psychology In Crisis And Herd Investing

Pacing Your Buying Activities

My Feeling Today

I'm experimenting my emotional feeling in the market correction today, not just because share price has fallen which makes it a cheaper buy, but also the psychological factor in trying to understand how investors would react given first a small market correction, buying activities, catching a falling knife, holding on for further drops and bigger market corrections.

I've experienced a correction with a magnitude larger than this, but I was much more inexperience back then.

Today, my focus was directed right at the target of the shares I've been researching for a long time but has not had the chance to add on. This includes potential new additions as well as the current holdings in my portfolio. There were some other emerging value play that came out of random, some companies which has not been in my watchlist but has caught my attention.

I believe this is what most investors would experience during a bear market. You have limited cash yet you have many more value emerging out of the correction. This is now no longer about a game where you had to pick winners. You are convinced that a lot of these companies are winners in the long run, but because you have only such limited amount of cash, you need to pick the best of the best such that you don't lose out on the opportunity funds.

I'm still not convinced I am seeing any panicking yet so the same would probably go to most investors out there. There are some who would hold on to their bullets while there are some who are nibbling a little out there already. Regardless, I hope everyone has a plan of their own so that they won't be caught naked or with too much clothes on when the tide turns around.

It's just the first day since a long time that we see such brutality in the market.

I'm sure more feelings will emerge in the days ahead should market plunge further.

What about you? How do you feel during a small market correction today?