I made a decision to divest all my current holdings for FCOT of 11,000 shares at a price of $1.525.

This has not been an easy decision (just like the recent FCT divestment) because they are two of those Reits that have been with me for the longest of time and have performed remarkably well since I purchased them. However, my strategy involves buying and selling at a valuation where I think gives me the best risk reward advantage and therefore at any given time, I had to consider if they have breached my limitations.

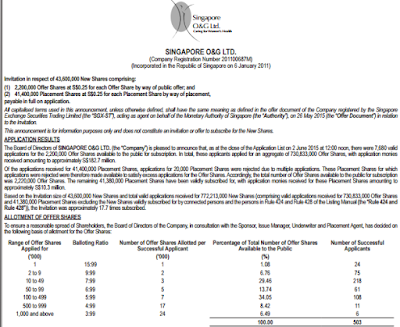

I had in the previous week written an article (Link Here) regarding the possible short term fluctuations about the placement activities in the acquisition of the 357 Collins Street, which are expected to be yield accretive but just SLIGHTLY yield accretive. The decision to divest is actually much more to it than meets the eye.

First, I am looking at this from the Reits and balance sheet structure point of view and have compared them against CapCommercial (CCT) and Ho Bee Land. While the current capitalization rate for FCOT is comparable to the other two companies mentioned, especially for the office properties located in Singapore, the Australian properties which they have on their books are having higher capitalization rate, so this gives them an advantage in terms of the net property yield the company is able to generate. However, in terms of balance sheet and NAV, I believe FCOT ranks the lowest amongst the other two and this is something that propels me to be more wary.

| Gearing (%) | P/BV | |

|---|---|---|

| FCOT | 37.2 | 0.99 |

| CCT | 29.9 | 0.91 |

| Ho Bee | 30.1 | 0.53 |

Secondly, given the parent’s company (FCL) obvious direction to divest more of their Australian properties into their Reits wings, there will be plenty of acquisitions opportunities for FCOT (And FHT) in the next few years ahead. It’s a little tricky here because given the structure of Reits to pay out majority of its earnings, acquisitions will have to be funded via debts and/or equity.

The point I am trying to make is given the relatively high current valuation of the Reit in terms of its NAV (compared against their relative peers), any drop in the stock price means that it is much more difficult for the company to acquire a yield accretive acquisitions since the net property yield of the acquisitions cannot be lower than the yield they are already offering to unitholders. We see the latest Collins Street acquisitions as one of those examples where the difference between the NPI and current yield are not significantly different. In other words, share price would have to continue to move upwards in order to make sense for them to issue equity at an attractive price. The management can always choose to fund the acquisitions via debt, which is a much cheaper form of financing, though the limitations of the gearing and the rising interest rate would not have helped them much.

Conclusion

The divestment has now increased my warchest fund in the range of 39% of the overall portfolio.

I have also utilized part of the proceeds from the sell to purchase something else today, a company which I think presents a better risk reward ratio in the long run. I may blog in the next day or two regarding the purchase, given if time permits. Let's see if the decision to do so in right over the long run.

I have also utilized part of the proceeds from the sell to purchase something else today, a company which I think presents a better risk reward ratio in the long run. I may blog in the next day or two regarding the purchase, given if time permits. Let's see if the decision to do so in right over the long run.

Thanks for reading.