Everyone seem to be talking about the IPO for Fraser Hospitality Trust (FHT) that Starburst gets hardly noticed by retail investors. There's a couple of fellow bloggers who have also blogged about this IPO so I will try to give my views here.

They will be offering 50 million shares (48 million shares for placement and 2 million shares for retail investors) at a price of $0.31. The IPO will close next week on the 8th July at 12pm.

Introduction

Starburst is a Singapore based engineering group specialising in the design and engineering of firearms-training facilities. The company has a track record and experience of close to 15 years in this niche industry.

Their business can be classified into 3 main business segments: Firearm Shooting Ranges, Tactical Training Mock-Ups and Maintenance Services and Others.

Financials

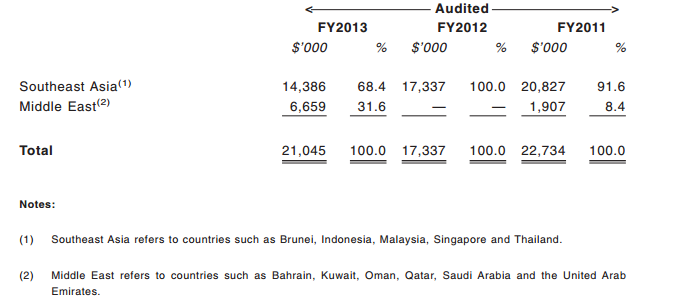

If you take a look at its Profit and Loss Statement for the past 3 financial years, both top and bottom line numbers are escalating, which is a great sign. They also have a healthy profit margin figures increasing from 26.4% in 2011 to 41.5% in 2013. I believe the management well execution track record in handling a more complex project resulted in this higher margin.

The balance sheet here might not have shown an insight into what those assets and liabilities are. A deep delve would show that the company has a $7.5 million borrowings from OCBC, Hong Leong Bank, and DBS. The fixed rate at OCBC is rather worrying as it bears a fixed interest rate of 5% per annum while Hong Leong is fixed at 1.88%. The DBS loans is floating.

Looking at the Cash Flow Statement, the main stand out would be the negative cash balances at the end of 2011 and 2013. Looking at it deeper, the negative net cash from operating activities is mainly due to the company's inability, perhaps due to business nature, to turn around their general working capital faster than they would like to. The company stated that due to the nature of their business, it is common for contractors to bill and receive payment for completed works only when the customers have certified that the projects have reached the relevant milestones. As such, the company may be required to pay the suppliers and sub-contractors first notwithstanding customer's pending verification.

The nature of the company's business means that they would also have to incur quite a high number of CAPEX for its machinery, plant and leasehold land and inventory. This means that Free Cash Flow is going to be lumpy in one year onto the next.

The company has intended a dividend policy of at least distributing out 20% of the Group Profit for 2014. At $0.31 cents, this stands to be about 2.17%

Use of Proceeds

The use of the proceeds from this IPO listing will mostly be used to fund its CAPEX acquisition of land and machinery (50%) while some 36% goes into funding its working capital.

My take

I think this is a fairly niche business with some degree of risk. Even the management has stated that one of its biggest risk is that almost 84% of its projects are non-recurring and their profits will depend on how they are able to find more complex projects to sustain their high level of profit margin.

Obviously, the management are optimistic about the growth of this business and it is easy to see why they are only opening up 50 million shares to the public. I suspect the reason they do so is to fund their continuous growth by using the proceeds to purchase land and machinery while they got into some trouble with their working capital turnover as well.

The current NAV after the dilution will be about 15.25, so at $0.31 the Price to Book value will be about 2x. Their PER after adjusting for the dilution will be about 8.88x.

If you are a long term investor, I think this is worth a bet for a run. Obviously, by only having limited liquidity in the market, it is hard to see how you can take a quick short term profit out of this. I suspect if you applied 1:49 lots, they probably will only allocate 1, while 50:99 lots will probably get you 2.

I will probably take a punt at this and keep this for the longer term if i do successfully manage to get them. Due to the small amount of public tranches this would be over-subscribed. But we'll see whether I am third time "unlucky" this time (The first two IPO was unsuccessful ^^)