You're a fresh grad out of university or you're one of those who have been dreaming about opening a restaurant or cafe and now you're raring to go to make your dreams come true. I have once been in this position - trying to live my glamorous dream, but yet not too sure on whether I had enough money to start off.

How much do you really need to budget your costs before setting up your restaurant or cafe?

This weekend I have the privilege to meet up with one of my former classmate who has been in the F&B business for the past couple of years. Through our conversation, I managed to gather some important considerations which I hope will help those who are thinking of setting up their own F&B business.

Before we start, I would like to present the hard truth figure to those who thinks of the glamorous successful rate of the F&B business. Based on the statistics over the past 10 years, slightly more than 70% of new businesses fail in the first year and about 90% of them fail in the next 3 years. That leaves us with only 1 out of 10 who are in existence after 3 years or more. One can remember that restaurants that have closed recently include Wok & Barrel, Preparazzi, Tea Cosy, One on the Bund and many more.

Budget Calculation

One of the main contribution for the high failure rate is usually due to either the underplanning of the costs or being over optimistic on the sales front.

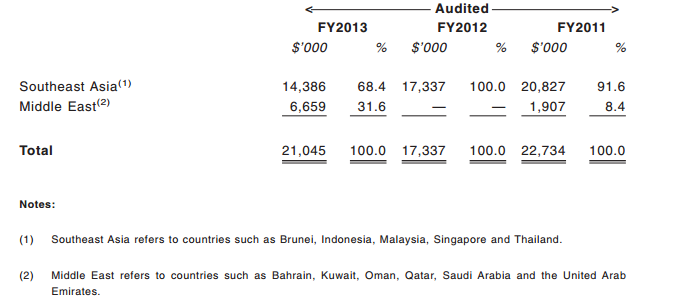

When I talked to my ex-classmate, he mentioned that the budgeting for F&B business are usually bottom-up - which means that we need to calculate the fixed and variable costs such as rent and raw materials and work our way up to determine the sales figure. Obviously, the lower the operating costs the higher chances you are likely to be successful in your business. So let's analyze deeper the importance of each components.

Rent

Rental costs are usually the killer factor we have in Singapore. One can look at a few owned Reits malls such as CMT or FCT and you can see how they are consistently revising their rental rates to increase their DPU and value to unitholders.

Based on Williams, Richard in his valuation journal in 2002, he mentioned that restaurant owners cannot afford to pay more than 5% to 8% of the total gross sales in rent if one is to be successful in the long term. In the Singapore context, my friend argued that it is virtually impossible to get the rent rate this low and he estimated the figure to be closer to 10% of total gross sales, unless the place warrant a premium of competitive advantage such as sea view or no competitor within the 2.5km radius, then it would make sense to add a percent or two more on top of it.

For example, the average price psf on Plaza Singapura is around $14/psf. So if you are looking to lease a small shop for your cafe at around 800 sqft, you are looking easily at around $11,200/month in rent. Taking the 10% rule, this means that you should be expecting around $112,000 in gross sales for the month or $1.34 million per annum. If you are looking to charge your customers at around $20 per customer, your breakeven point would be at 183 customers/day.

Some landlord will propose a variable component on top of the fixed rent. So you might get something like $6,000 + 5 % of sales. In this case, your rental costs are no longer fixed and have to bear in mind the variable components involved.

Food (Raw Materials)

The general rule of thumb is your costs for the food and other raw materials should never exceeds 35% or 1/3 of your overall gross sales. Price is always a sensitive factor to the consumers and not something that can be easily passed down to your consumers even if the price of your raw materials is up. To ensure that you get the cheapest deal, ensure that you have a network of vendors who are willing to work long term with you in times of good and bad economy. Having said that, it is important not to compromise cheap for quality as this will backfire in the long run.

Labor Costs

Labor costs are another difficult component to handle especially in Singapore. The labor tight crunch means that you probably need to hire foreign workers who are willing to dedicate service and the right attitude to the customers. The general rule of thumb is these costs should not exceeds 30% of your overall gross sales. Think of ways on how you can save costs by using automated service, e.g there are a few Japanese restaurants who are using IPAD for order and delivery of the food. The more you can save these costs at start, the higher likelihood you are going to succeed in your business.

Other Intangibles

These intangibles such as service, attitude, timeliness of the delivery and consistent quality of the food are key important ingredients to customer's brand loyalty. Often, many restaurants and cafes neglected on these aspects which can prove to be costly to the business in the long run. With Facebook, Tweeter and Instragam highly dominant in the modern technology of our everyday lives, the word of mouth can spread rather quickly for your business - either good or bad.

|

| Sample P&L done by B |

I am not an expert in this business but I think it is interesting to understand how the successful of an entrepreneur goes back to how prudent he is on the budgeting. As with investing, the higher the margin of safety, the higher chances you are likely to be the one standing out in times of adversity.

The next time you want to venture out opening a restaurant of cafe, ask yourself again, how well have you prepared?